Solving Ongoing Challenges Through Partnership

After successfully managing the conversion wind-down project, CorroHealth began handling more of the health system’s aged accounts, leading to a long-standing 10-year partnership.

“CorroHealth is a valued partner in our revenue cycle strategic plan,” said the Hospital System’s CFO. “They handle our small-balance claims accounts across commercial, Medicare Advantage, Medicaid Managed Care, aged accounts, conversion wind-down projects, as well as other strategic projects.”

Today, CorroHealth begins managing claims when they are over 30 days outstanding and under $1,200. Claims exceeding $1,200 are addressed on day 90, and those associated with hard denials—complex cases related to medical necessity, lack of authorization, or non-covered benefits—are handled on day 15. This structured approach allows the hospital staff to concentrate on more recent, higher-value claims, optimizing internal resources and reducing outsourcing costs.

Furthermore, CorroHealth supports the health system’s registered nurses by managing clinical appeals and employs a hybrid onshore/offshore staffing model to tackle ongoing human resource challenges.

Long-Term Results

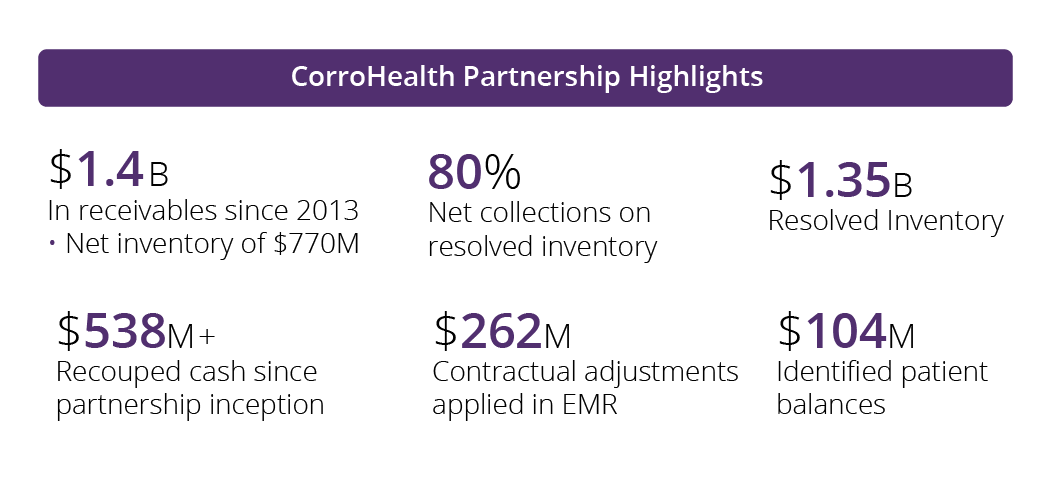

The partnership’s impact is significant. Since the collaboration began in 2013, CorroHealth has managed over 1.2 million claims, totaling $1.4 billion. The company has successfully resolved $1.35 billion in inventory, achieving an 80% net collection rate on resolved inventory. Additionally, CorroHealth recouped $583 million in cash, applied $262 million in contractual adjustments to the EHR, and identified $104 million in patient balances.